Good afternoon, my name is Bob Jablonski. I'm an enrolled agent located in Richardson, Texas. My firm is Bob Jablonski & Associates and we provide tax services to individuals and businesses. Our services include tax preparation and planning, as well as IRS representation for collection issues and added issues. We also work with the state of Texas controller's office. In previous discussions, I've covered topics such as IRS liens and the silent wing. Today, I will be discussing the importance of the notice of federal tax lien (NFTL). First, let's take a brief overview of tax liens. Tax liens are a crucial tool used by the IRS for collection purposes. They are authorized under Section 6321 of the Internal Revenue Code and attach to all assets owned by the taxpayer at the time or after the lien is issued. However, it's important to note that the lien does not supersede any existing liens already in place. For example, if you have a home with a loan from a bank, the IRS lien will not take priority over the bank's lien. Instead, the IRS lien will be placed between you and the bank, allowing the IRS to collect any equity beyond the loan amount. To have a valid tax lien, there are three prerequisites. Firstly, the IRS must assess the tax liability, which is now done almost immediately with electronic filing. If a paper return is filed, it may take longer for the IRS to process and assess the tax liability. Secondly, the IRS must provide notice of the assessed tax and demand payment to the taxpayer. Finally, the taxpayer must fail to pay the assessed amount within ten days of receiving the initial notice and demand. Now, let's discuss the types of IRS liens. Last week, we covered the general lien or...

Award-winning PDF software

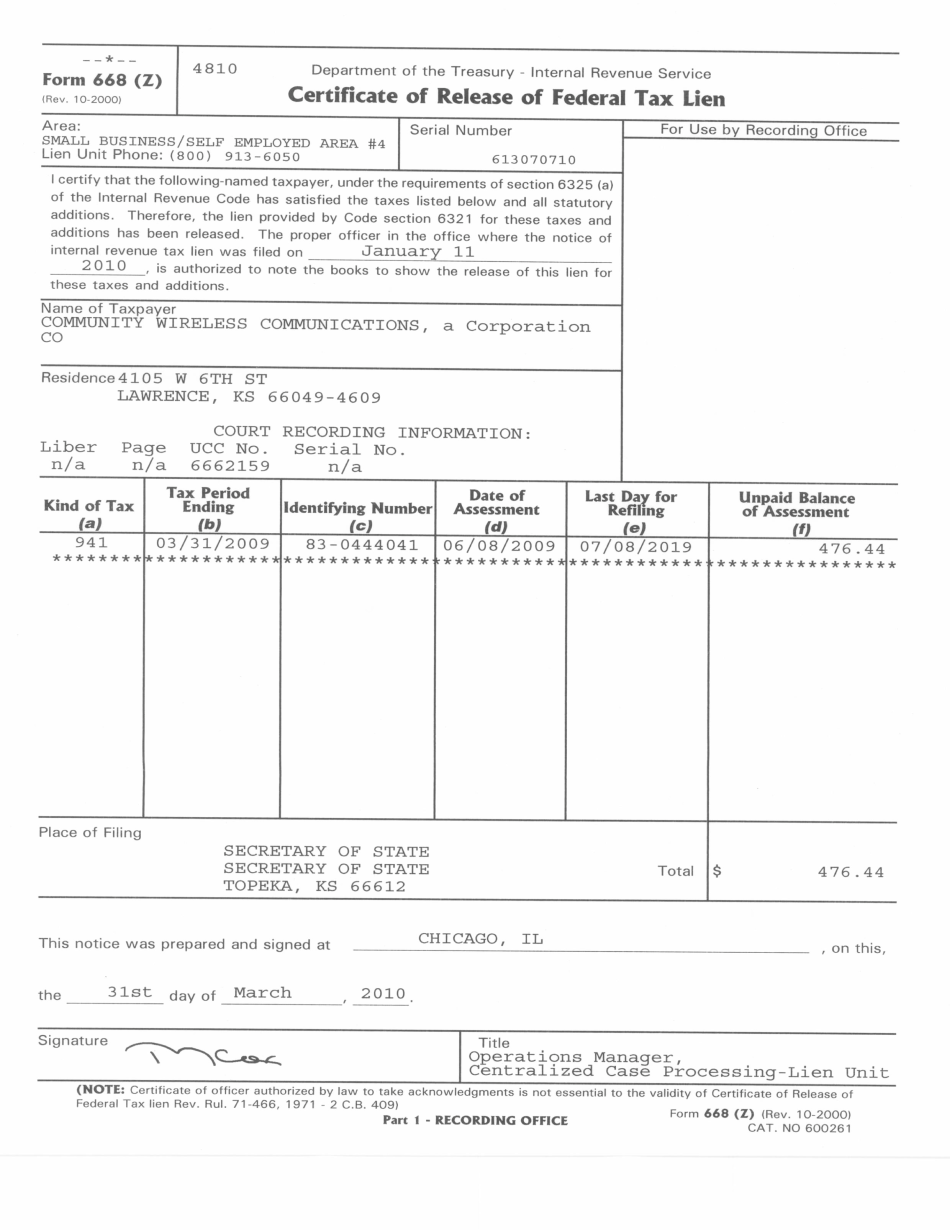

668(Z) Form: What You Should Know

The purpose of 668 (1) is to notify the taxpayer of the assessment or collection and (2) is not intended to make payments to the government. The 668 series (1) and (2) are intended to provide information only and to be used only to support audits and enforcement cases. The 668A series Notice of Levy (Accounts) is filed by IRS along with the 1st installment of 1st class Postal Service money order or by wire transfers (for individuals, the payment may be made electronically). If there was a refund (for individuals, the taxpayer should make a payment to the IRS or credit his refund account for the refund). The 2nd installment is the IRS's due date for the 2nd installment of the 1st class Postal Service money order. The notices are sent either by mail or by wire. When to file each 668 series Notice of Levy, see Taxpayer Tip sheet (PDF) (1), (2) and (3). 668 series Notice of Levy will require a 2nd installment money order, the following payment due date must be paid at least 15 Days prior to the return Due date for any subsequent installments. For the 1st and 2nd installments, the due date is 1 year prior (1st), 2 years prior (2nd), or 3 years prior (3rd). However, payments made on or after the due date may be withheld from any subsequent installment. As an individual, the 668 series form 668 (3) is the only lien form that can be claimed on the federal income tax return in order to offset the amount of future federal income tax that was not deducted by the taxpayer before filing the tax return. However, the lien form 668 (3) can still be used to offset the portion of future federal income tax that was previously deducted by the taxpayer and which will be paid by the government, provided that the lien form 668 (3) be signed in accordance with the applicable rules (see Pub. 535. See also IRS Publication 519, Internal Revenue Manual, for additional information including instructions for signing lien forms). However, filing lien form 668 (3) does not protect the taxpayer in situations where the unpaid tax cannot be paid to the government, is due to a refund or is not subject to any withholding.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 668(Z), steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 668(Z) online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 668(Z) by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 668(Z) from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 668(Z)