My name is Patrick Sheehan, and I am a former IRS attorney. What are the IRS statutes of limitation in my tax case? You've heard about statutes of limitation, and typically statutes of limitation refer to personal injury-type cases. For example, if you slip and fall at a store, you have a certain period of time to bring a lawsuit against the store. The reason for this is the Fairness Doctrine - people move, memories fade, and documents are lost. Therefore, you must take action within a specific time frame. This concept applies to tax cases as well. If you file a tax return, the IRS has three years to audit you. However, if those tax returns underreported your income by 25%, then the IRS has six years to audit that tax return. In cases involving fraud, the IRS can audit that tax return at any time, and you may even face imprisonment. On the collection side of things, the IRS has ten years to collect money from you. For instance, if you file your tax return on April 15th, the IRS makes an assessment against you, and then they have ten years to collect that money. There are certain actions you can take to extend the ten-year statute. For example, you can file an offering compromise or even file for bankruptcy. Furthermore, signing a waiver can give the IRS more time to collect money from you. If any of these actions occur, the 10-year period is extended based on what you did. In a recent case, a taxpayer owed $400,000 to the IRS. Through obtaining internal documents called transcripts of account, we discovered that the ten-year statute of limitation was about to expire. Therefore, we prepared for that 12-month period, allowing the statute to expire. As a result, our taxpayer is now free...

Award-winning PDF software

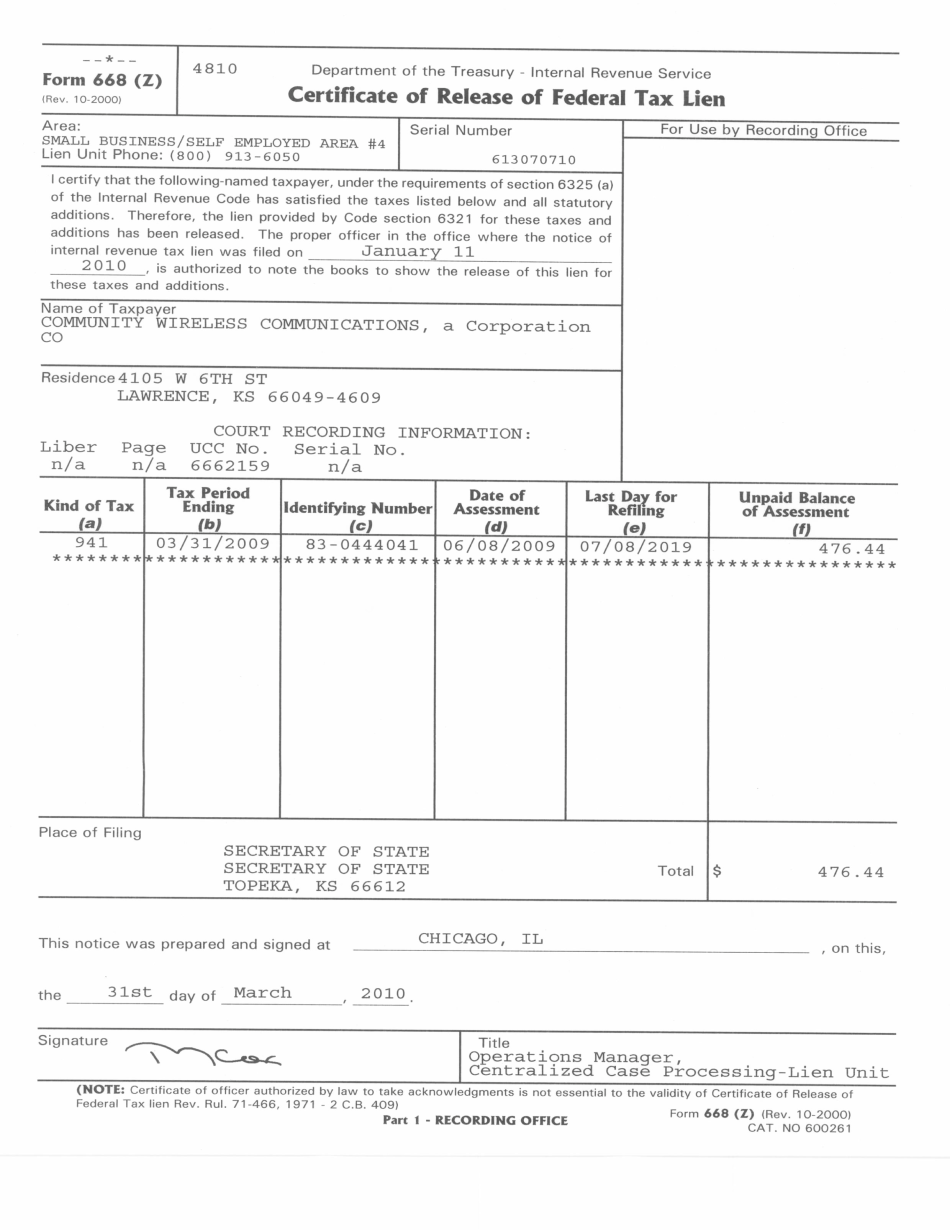

Irs lien release after 10 years Form: What You Should Know

The amount released is subject to change. 5.12.19 Withdrawal of Notice of Federal Tax Lien — IRS To get the tax lien released, the taxpayer can either pay its total debt to the IRS or ask the agency to withdraw the notice. 5.12.28 Withdrawal of Notice of Federal Tax Lien — IRS The notice of tax lien can be withdrawn by filing the Request to Withdraw the Notice of Federal Tax — IRS Form 8829 and attaching a valid check or money order to the form (not including the original or certified check, money order or cashier's check issued by the IRS). The form is available from IRS Taxpayer Assistance Centers (TAC). 5.12.52 Notification of Discharge of the IRS Lien — IRS When the notice of tax lien is withdrawn, it should not be mailed to the taxpayer. In most cases, the USED is dissolved only after the IRS sends the notice stating that the lien has been discharged. Taxpayers who desire this type of information must request a waiver from the IRS Taxpayer Advocate Service (TAS) to do so. (See TAS Form 3879-0, Notice with Application to Remove Notice of Lien. ) 5.12.54 Notice of Termination of the USED — IRS The notice of the terminated USED must be sent to the TAC within 5 business days of the notice of termination. The TAC receives information on the status and status of IRS lien notices; if a notice is still open, it will be posted promptly. 5.12.56 Waiver of Withholding of Tax Lien from the IRS — IRS A taxpayer who files an IRS Form 8829 in which they request to remove their notice of an IRS liens and requests to remove the liability from their tax return must fill out a waiver form (TAS Form 3879-0, Notice of Withholding of Tax Lien) and submit it to the TAS. 5.14 Withholding of Federal Tax Lien — IRS The IRS has the right to withhold federal tax liens from U.S. citizens and residents. (See Regulations section 1.601(a)(2)(ii)). The IRS collects and uses this information to determine whether to withhold tax. 5.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 668(Z), steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 668(Z) online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 668(Z) by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 668(Z) from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Irs lien release after 10 years