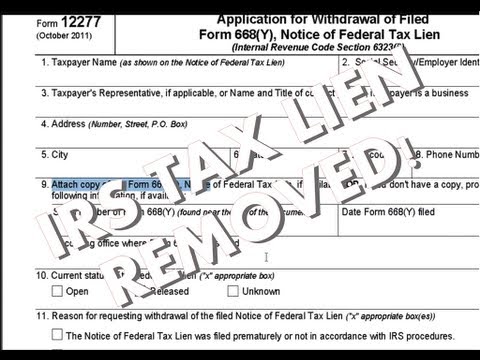

Everybody, Dave Sullivan here for The Credit Guy TV. My number one video that I've done so far has been about removing an IRS tax lien from your credit report. I actually had a client who followed my instructions and successfully got it removed under the new program that I announced about a year ago. Now, I want to walk you through the step-by-step process and the documentation they used to get it removed so that you can easily follow these instructions and do it on your own. Let's start by looking at the application form for withdrawal of filed tax lien, which is Form 12277. You can find a link to this form on my Facebook page under the notes section. Just visit facebook.com/thecreditguy and look for the link there. The form requires you to fill in the taxpayer's name, social security number, address, city, state, zip code, and phone number. You should already have this form if the tax lien was established. If you don't have it, you may need to request a new copy. Remember, you need to include this form with your application. Now, let's move on to question number ten on the form. Here, you will indicate the status of the tax lien as either open, released, or unknown. Choose the appropriate status. In question number eleven, you will need to check the that says "unless one of these apply." This is the option you want to select in order to get the tax lien removed from your credit report. For question number twelve, I would suggest stating that you would like the tax lien removed under the new IRS policy and that you meet all the qualifications and eligibility. Print out the form and mail it, along with everything else, to the three credit reporting agencies. Make sure...

Award-winning PDF software

Can the irs refile a tax lien Form: What You Should Know

IRS can refile its liens late — after 30 days —but their priority is at risk for any intervening event. Using the Federal Lien Registry to get the latest IRS information. 5.6.2 Lien Release or Amendment for Bank Accounts Held in an Unconsolidated Bank Oct 07, 2025 — Under IRM 5.6.4, the taxpayer may file for a bank account holding bank instruments (including money market funds) and issue a Form 5500-T in the form of a bank statement showing the sale, exchange, or redemption of the bank instrument holdings. The following are the forms listed there for each bank holding account type and for any bank account types to which IRS has already issued a Form W-9 in connection with other accounts. Form 8300, Application for Certain Credit Bonds and Certificates of Participation in Private Placement Transactions; Form 8300-A or Form 8300-B, Application for Certain Credit Bonds and Certificates of Participation in Private Placement Transactions With Foreign Bank Entities; Form 8900-C, Application for Certain Credit Bonds and Certificates of Participation in Private Placement Transactions With Foreign Bank Entities; Form 7086, Certificate of Participation in the United States Securities and Exchange Commission; Form 4562P, Certificate of Title to Property in Lieu of Federal Tax Liens; and Form 4562-S, Certificate of Title to Property in Lieu of Federal Tax Liens. 5.6.1 Bank Account Holding Bank Instruments — IRM 5.6.4.3. 5.6.1.1. Where do I file? IRM 5.6.4.1. It depends on the type of holding account. Note that the Bank Secrecy Act (BSA) generally does not bar the submission of returns electronically. If you are submitting a Form 1099-B with respect to all banks, it is possible to use IRS.gov to access the electronic filing system for Form 8300, Application for Certain Credit Bonds and Certificates of Participation in Private Placement Transactions With Foreign Bank Entities. 5.7.9 Bank Account Holding Bank Instruments — IRM 5.6.4.3. 5.8.2 Bank Account Holding Bank Instruments — IRM 5.6.4.3. 5.9.1 Bank Account Holding Bank Instruments — IRM 5.6.4.3.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 668(Z), steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 668(Z) online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 668(Z) by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 668(Z) from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Can the irs refile a tax lien