Award-winning PDF software

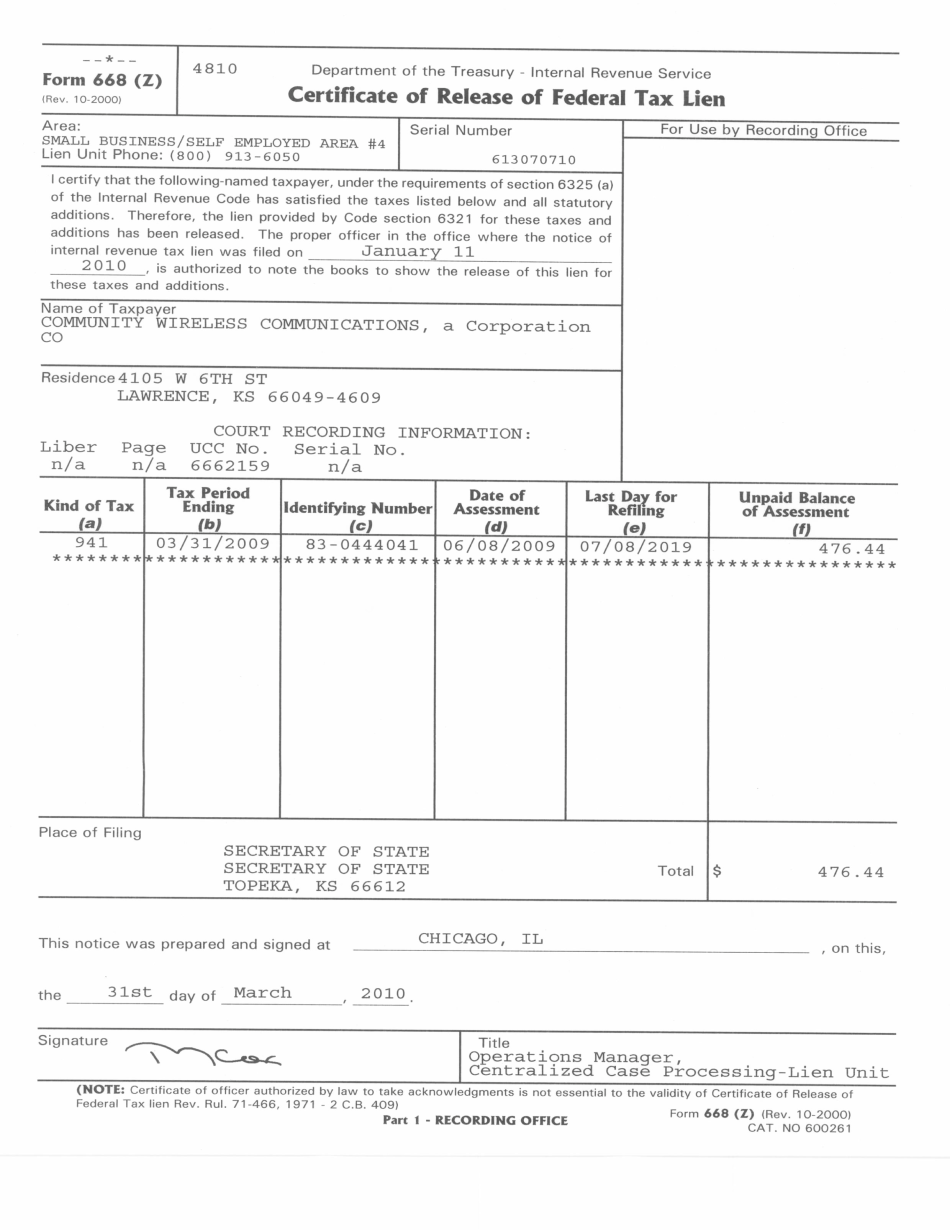

Tax lien discharge Form: What You Should Know

NOT allowed transferring, alter, or eliminate the lien until the tax has also been discharged. So what is the process of Discharging IRS Lien? Form 14135 To discharge IRS Tax Lien, you will need to prepare and file IRS Form 14135. Note: Please do not print IRS Form 14135, Application For Certificate of Discharge of Federal Tax Lien, and mail it by hand because it may be returned by the U.S. Post Office with postage-paid return envelopes. Please download IRS Form 14135 in PDF format or PDF format and mail it in the mail by certified mail (return receipt requested) to the following: Internal Revenue Service Attn — Filing Officer, Lien Release Unit U.S. Post Office 2601 W. Belmont Ave. Chicago, IL 60 IRS Lien Discharge: What Documents Do to Have to Show the Deposition? After mailing down any required documents, make sure to have the following: The original certificate of discharge of the property, with the original certificate of filing (you need to send the form with the Certificate of Original Lien Release). I.e. If the original receipt was included with the deed, attach the original receipt with the original certificate of release The property deed (if a sales contract was used to transfer the property), and Copies of all documents related to the property. The copies should include the sales contract, the deed, and any other document which may be related to the property. If other liens or mortgages are also listed, please check with the sailors to get a copy. The IRS has a form 1350 to get a copy of any or all mortgage documents (including the deed). What Is Your Remedy? If you cannot find a way to discharge the tax lien on the property (including the sale), you may then file an appeal with the IRS. The appeals process takes two to three years. Your appeal will be routed to the appeals unit at IRS.gov The appeals case number is (EAG-000001) However, you may still consider filing an answer. Your answer will be routed to your account manager at IRS.gov.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 668(Z), steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 668(Z) online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 668(Z) by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 668(Z) from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.