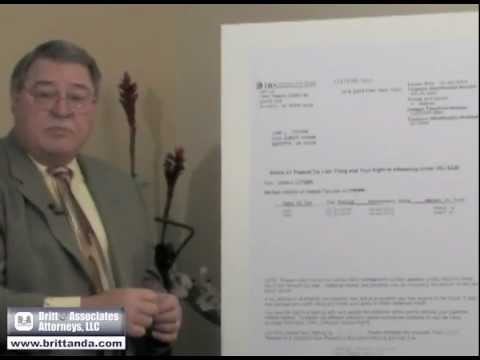

If you received a notice of federal tax lien from the IRS, you need to take action. Your property and your rights are at risk. You must not wait. The plain truth is, you should never ignore any IRS notice. We, at Britton Associates, would be happy to explain to you in detail all the possible consequences and your legal options if you have received a notice of federal tax lien. The notice of federal tax lien is simply the written notice by the IRS that it claims a lien or right against whatever property you may own. It claims a right against your assets. Normally, the IRS will file it in the local courthouse where tax record court property records are kept. A federal tax lien affects three things: your property rights, your IRS appeal rights, as well as your credit rating. The notice of federal tax lien has three key items of information. First, the date of the notice determines the deadlines that you must file any appeal to the IRS. Second, it gives the officer and the address to whom you must address any appeal. Third, it gives the type of tax, the tax year involved, and the amount of that tax. In addition, it gives the assessment date. The assessment date is important because it gives the start of the 10-year statute of limitations for collection. The notice of federal tax lien can have a severe and dramatic impact on your financial condition. All three credit reporting agencies will normally report the federal tax lien, thus affecting your credit rating. In addition, the federal tax lien attaches to all property, including any equity that you may have. Thus, if you sell or pay off a particular piece of property, the IRS collects. Furthermore, the IRS tax lien remains in...

Award-winning PDF software

Do i have a federal tax lien Form: What You Should Know

Liens do not have to be discharged or subordinated when a taxpayer's property is sold. However, the terms of the lien release and subordination will control. What Does a Release for Release of Tax Liens Mean? — IRS Here's the thing: If you want your property to be sold, you must apply for the release from the IRS of the lien. There is no automatic discharge of a tax lien. If you are considering selling your property at a low sale price, and you do not want to go through the hassle of application, then you might want to consider a release of all or part of the tax liens. Here's an example. If you take a loan to start a business, and you decide that it is not viable or can't make your monthly payments, then the IRS can file a notice of lien to force you to sell your property and pay off the loan early. If you don't release the liens to the public, the IRS can file a civil action to regain possession of your property. If you purchase a rental property and decide that the property is not going to be a long term living situation in the end, then you might decide that you don't want to have to pay the property taxes, and you want the IRS to release the tax liens on the property so that you can sell it. How To Obtain a Release of Tax Liens The release can be done by using the online form or by applying in writing along with the required documents. Include the following: · Your full name, address and other identifying information. · Payment showing the full amount of the tax lien. · Copy of the notice of lien. · If the notice of lien includes a claim for the release of the tax liens, attach that claim. Note: If the notice of lien is not filed, or you do not submit a lien release with your application, you will not be notified. The IRS will not issue a notice to you and there is no automatic release of the tax liens. WHAT IF THE IRS DOES NOT RE-LEASE MY TAX LIEN AFTER I APPLY? Don't let that stop you.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 668(Z), steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 668(Z) online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 668(Z) by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 668(Z) from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Do i have a federal tax lien