Hi, my name is Vernon. I'm the president of Taxi LLC. So now, let's talk about federal tax liens. A federal tax lien is the United States government placing the public on notice that they have rights to any assets that you may have to pay a pass-through tax liability. Basically, if you owe the IRS some money and haven't been able to pay, the IRS will file a legal document in the county where you reside, which notifies the public of your debt. This information is also sent to all three credit reporting bureaus, letting your creditors know that you owe the Internal Revenue Service money. The rules regarding tax liens are relatively simple. The IRS will file a lien for any amount of money over $5,000, although this amount may vary in different regions of the country. Some regions will file a tax lien for as little as $100, while others may require a commission or a debt of $7,500. Under the Fresh Start initiative, the IRS generally cannot file a tax lien for any amount below $10,000. The purpose of the tax lien is to protect the government's interest in case you acquire assets or move properties that could satisfy your debt. If the IRS believes their interest is threatened, they will file a federal tax lien. There are several ways to have a tax lien removed. The fastest method is to fully pay the tax liability. Once you have paid the tax bill upfront, the IRS will release the federal tax lien. However, the record of the lien will remain on your credit bureau report for up to seven years, affecting your credit during that time. If we want to have the tax lien withdrawn due to a defect in the assessment of the tax, such as the IRS...

Award-winning PDF software

Irs letter 3640 Form: What You Should Know

If the NFL Request cannot be performed in-person, the individual must send a completed Form 12636 (in PDF format) to the address (click here) by May 1. Mail the notice to: P.O. Bldg. 1660, Suite 500-E 8007 Commerce Pkwy Washington, D.C.

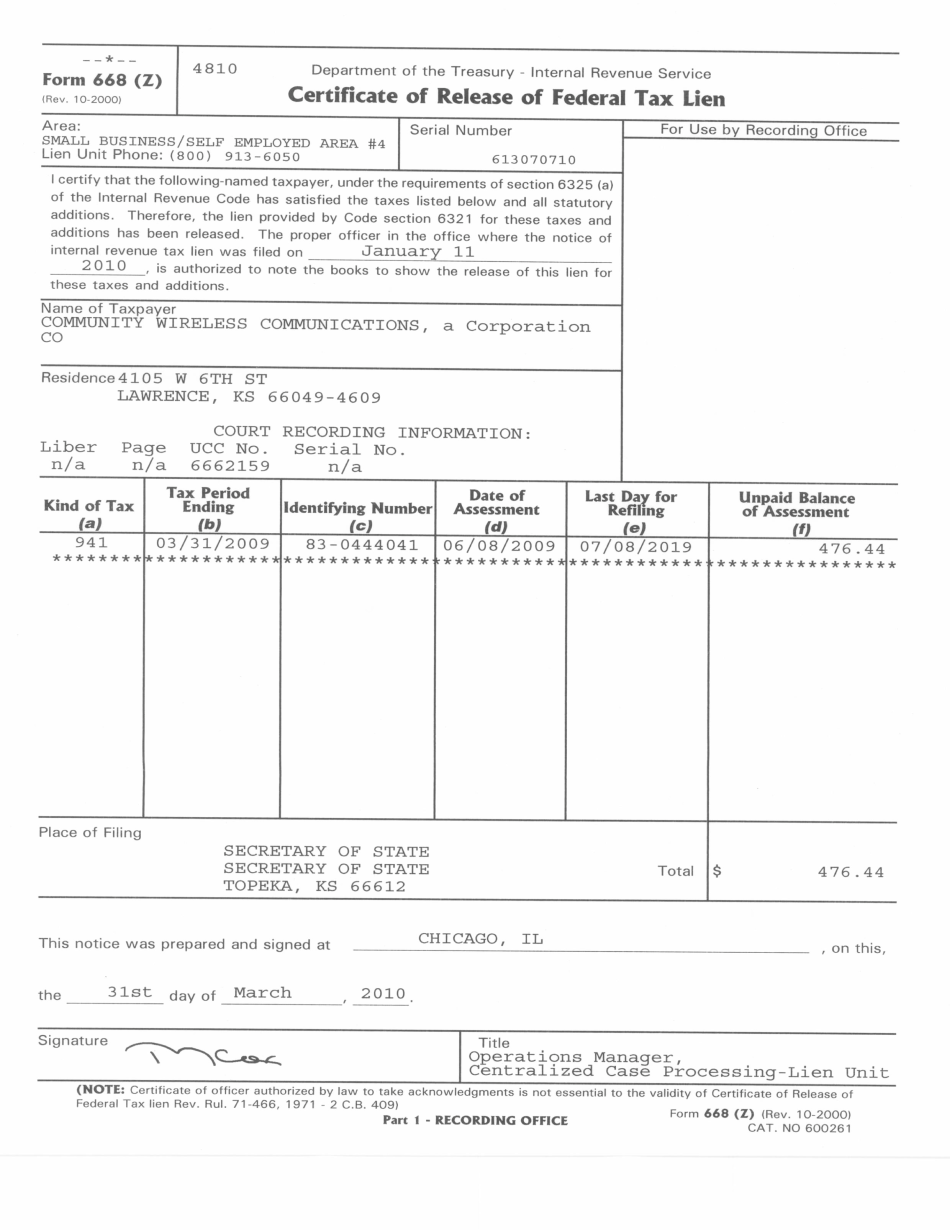

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 668(Z), steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 668(Z) online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 668(Z) by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 668(Z) from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Irs letter 3640