Award-winning PDF software

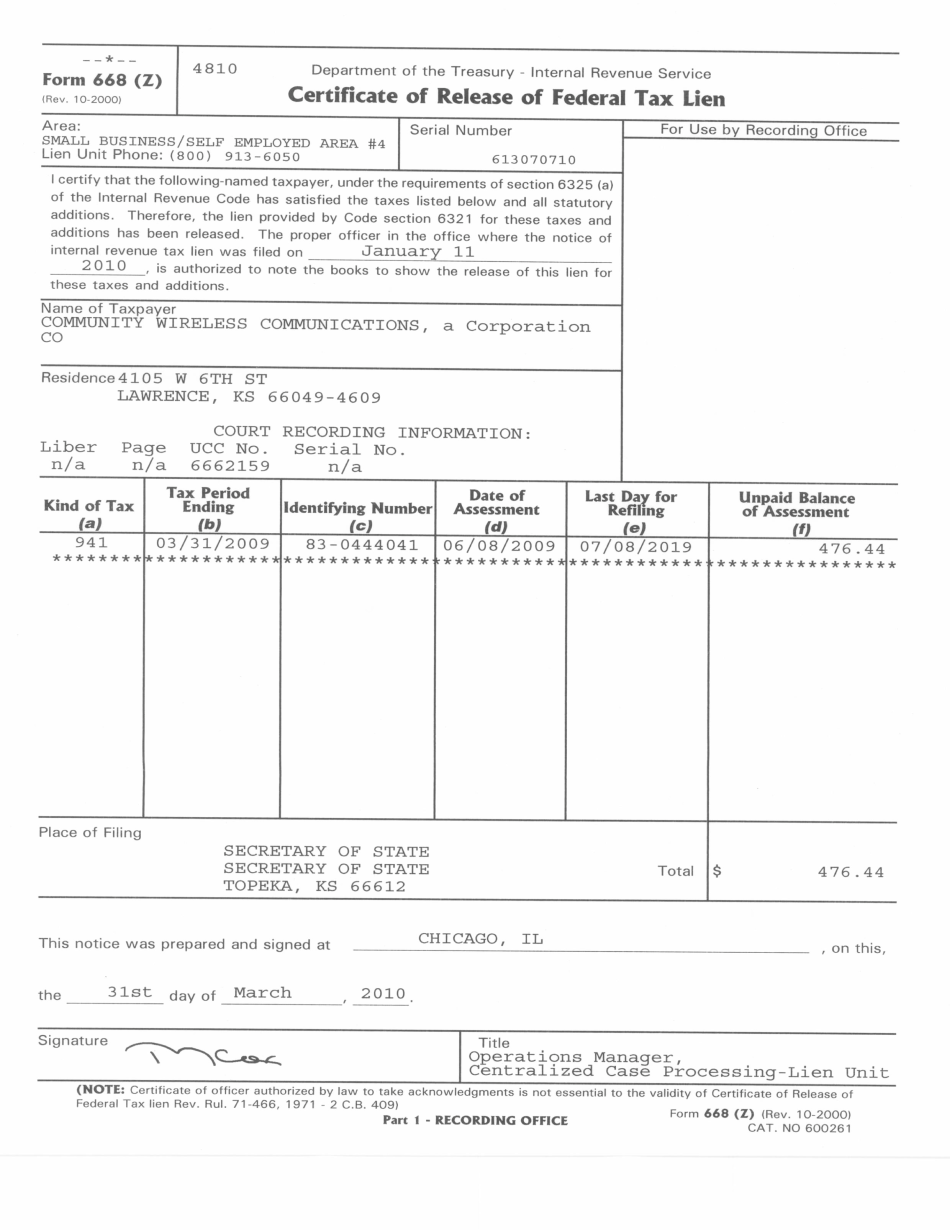

Printable Form 668(Z) Jersey City New Jersey: What You Should Know

File an IRS Form 668 W for the amount of the wages, salaries, and other income of the taxpayers that were subject to a levy prior to the effective date of this resolution (a) of this directive (ii) of the resolution. (iii) If this levy is not considered for the first year of the assessment phase of the assessment, the assessment phase shall be considered a second year of assessment and shall be reported on the final, two-year assessment rolls. (iv) The taxpayer has 30 days to file with the assessor a copy of the levy payment form. (v) The wage, salary, and other income levy is in lieu of the tax assessment on wages, salaries, and other income because of a deficiency amount of 150,000 or less. (vi) No further notices will be furnished to taxpayers with a net worth below 1,000,000 on or before the 25th day following the date this order goes into effect. (vii) The levy will continue until no further levy petitions are received. 5.12.8 Form 663 — NJ Dept. of Treasury Form 663 is used for tax assessments only, but it can also be used to obtain a Certificate of Authority for a new or modified assessment. Form 663 can be ordered from the Treasury Online Store. 5.12.9 Form 812, Certificate of Revenue Collection (IRS E-File Form 811) When the levy is to be filed to recover a tax, Form 812.3 is mailed to the taxpayer. Note the instructions regarding filing to recover a tax. 5.13 Tax Liens and Tax Exemptions 5.13.1 General Rules. A tax lien is a security interest in real property that exists for the benefit of the taxpayer. The owner of a tax lien or any beneficiary of the lien has the right to pursue enforcement of the lien through a levy, sale, or other proceeding. Any person, including a government agency, holding a tax lien, other than a trustee, may sue to recover possession of real property subject to the tax lien. 5.13.2 Liens. The lien must be filed in the county in which the real property subject to the lien or where the real property is being used, as described in the notice of levy on wages, salary, and other income (Form 668 (Y)).

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 668(Z) Jersey City New Jersey, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 668(Z) Jersey City New Jersey?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 668(Z) Jersey City New Jersey aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 668(Z) Jersey City New Jersey from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.