Award-winning PDF software

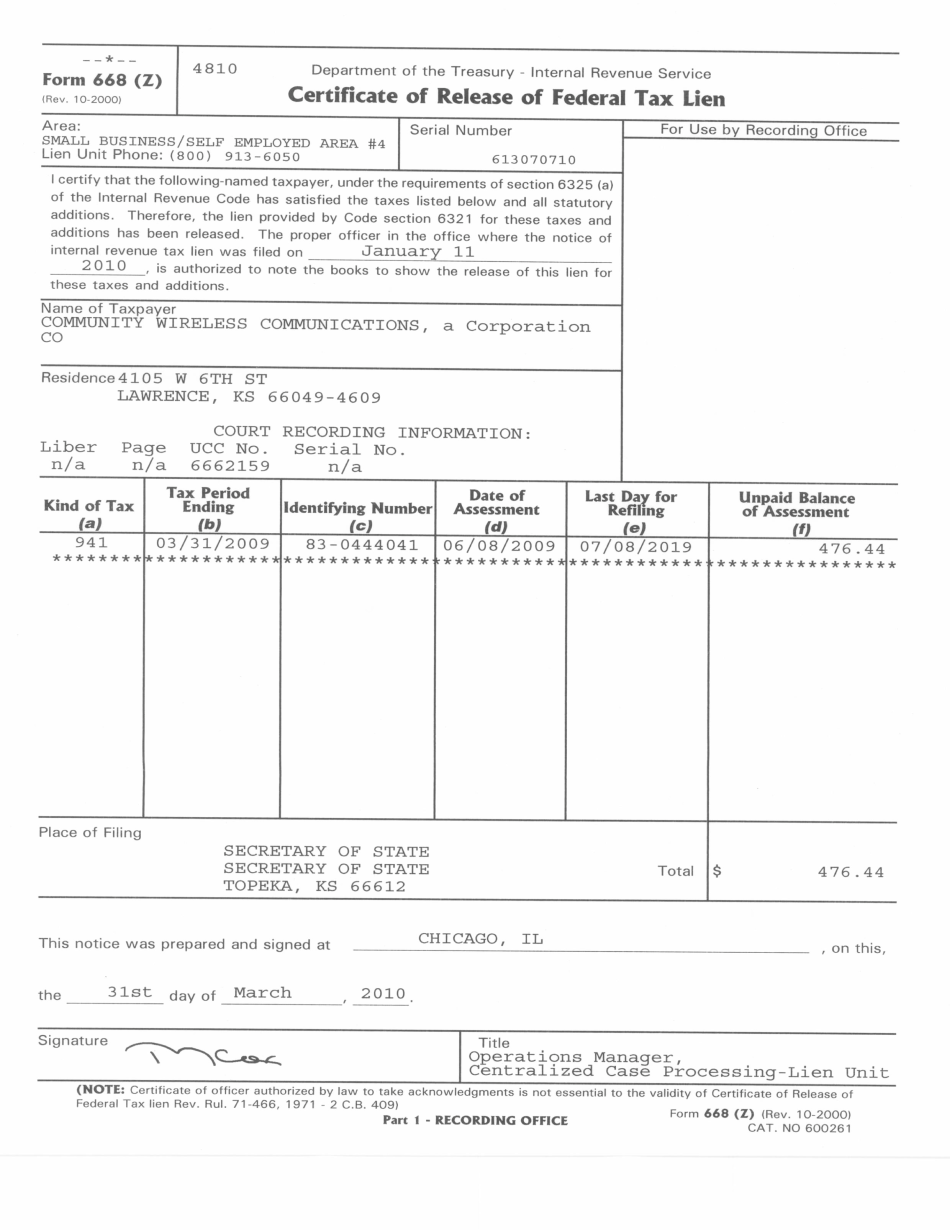

Printable Form 668(Z) Roseville California: What You Should Know

But not to exceed 2,100.00. If you file your 2025 return online or download on a paper slip, you will need to complete all the following: (1) For wages and salary that were paid during 2018, 2018.5 or 2019, the amount of wages or salary of the year immediately prior to the filing of your information return; and (2) For wages and salary that were either paid in 2025 or 2017, the amount of wages or salary equal to at least 30 percent of the amount of wages or salary that were paid during 2025 and 2025 (if paid in each year, the amount paid in the year immediately prior to the filing of your return is used); and (3) For any wages or salary not paid by payroll deduction during the calendar year before the filing of the return, the amount of wages or salary equal to at least 15 percent of the amount of wages or salary that were not paid during the calendar year from which that wage or salary was deducted. If you file your information return by paper or fax, there are 2 additional optional steps you must take: (1) For a wage or salary paid in 2018, submit Form 668-W (Wage or Salary Payment) by fax to; and (2) For a wage or salary not paid by payroll deduction in 2017, submit Form 668-W (Wage or Salary Payment) by mail to: IRS Filing Status: 2017 The required return information will be emailed to you. If we receive a photocopy of the information within 10 days, it will be accepted by the IRS as a complete or correct return. If you have filed with us more than once and received a notice of a partial-return levy, you will have to file all applicable claims separately, and then file the partial-return levy notice with form 13794 to release the lien. If, upon receipt of the partial-return levy notice, a claim is filed that was not previously filed, a penalty will be assessed, which is explained in the form of interest and other fees, as set forth on the notice.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 668(Z) Roseville California, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 668(Z) Roseville California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 668(Z) Roseville California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 668(Z) Roseville California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.