Award-winning PDF software

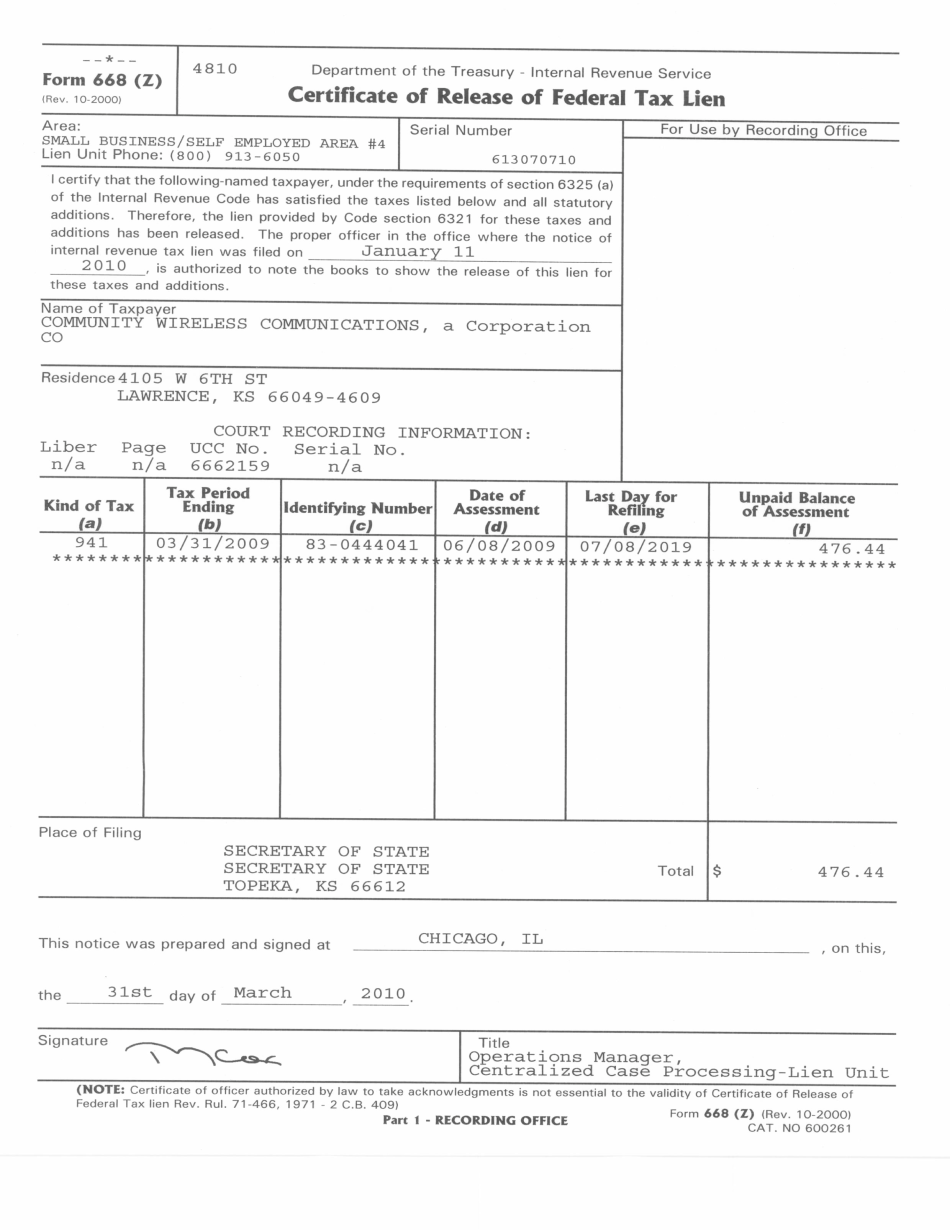

Printable Form 668(Z) Santa Clarita California: What You Should Know

Please do NOT send paper applications through e-mail without an additional fee. If you would like to apply by fax, please call the CAC Tax Counsel or mail your completed Form 668 to: Attn: CAC, Box 41001, Sacramento CA 95 (Note: CAC is now closed on Mondays). Tax Examiners or Tax Advisers -- State Treasurer's Office The CAC will only process paper applications when a valid and certified fee is received by the CAC. To avoid being charged fees for electronic filings, please: Fee: Payment by credit card or check; No more than 1,550 in unpaid tax returns filed for a given tax year. Any return filed for more than 18 months ago will not be processed. To learn when the CAC can process your application, click on the “My Account” link and enter your account number. Important: Your personal information will be retained until all fees and fines have already been paid. This would include any outstanding assessments or penalties issued by the Federal Executive or State Treasurer. Do not send your request at the same time that you file with the CAC. To learn more or to find the form 668 your county's taxing authority uses on the Taxpayer Appraisal Subcommittee of the California State Tax Association, call. Or contact The Tax Committee, 565 N Street, Suite 1000 Sacramento, CA 95834 The Application sheet may require a completed IRS Form 4251 to provide proof of identity. There is NO tax due if the applicant provides a certified or authentic Social Security number if not a U.S. citizen. If you do NOT have an IRS Social Security number, you are eligible to apply and waive the IRS Social Security number request. We will not process this request without a verified IRS Social Security number. The Application is to verify your identity AND is NOT for the purpose of collecting the tax. There are no extra fees for non-citizens if you provide a U.S. Citizen Social Security card when asked to do so. The application must be signed by a NOTARY PUBLIC.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 668(Z) Santa Clarita California, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 668(Z) Santa Clarita California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 668(Z) Santa Clarita California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 668(Z) Santa Clarita California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.