Award-winning PDF software

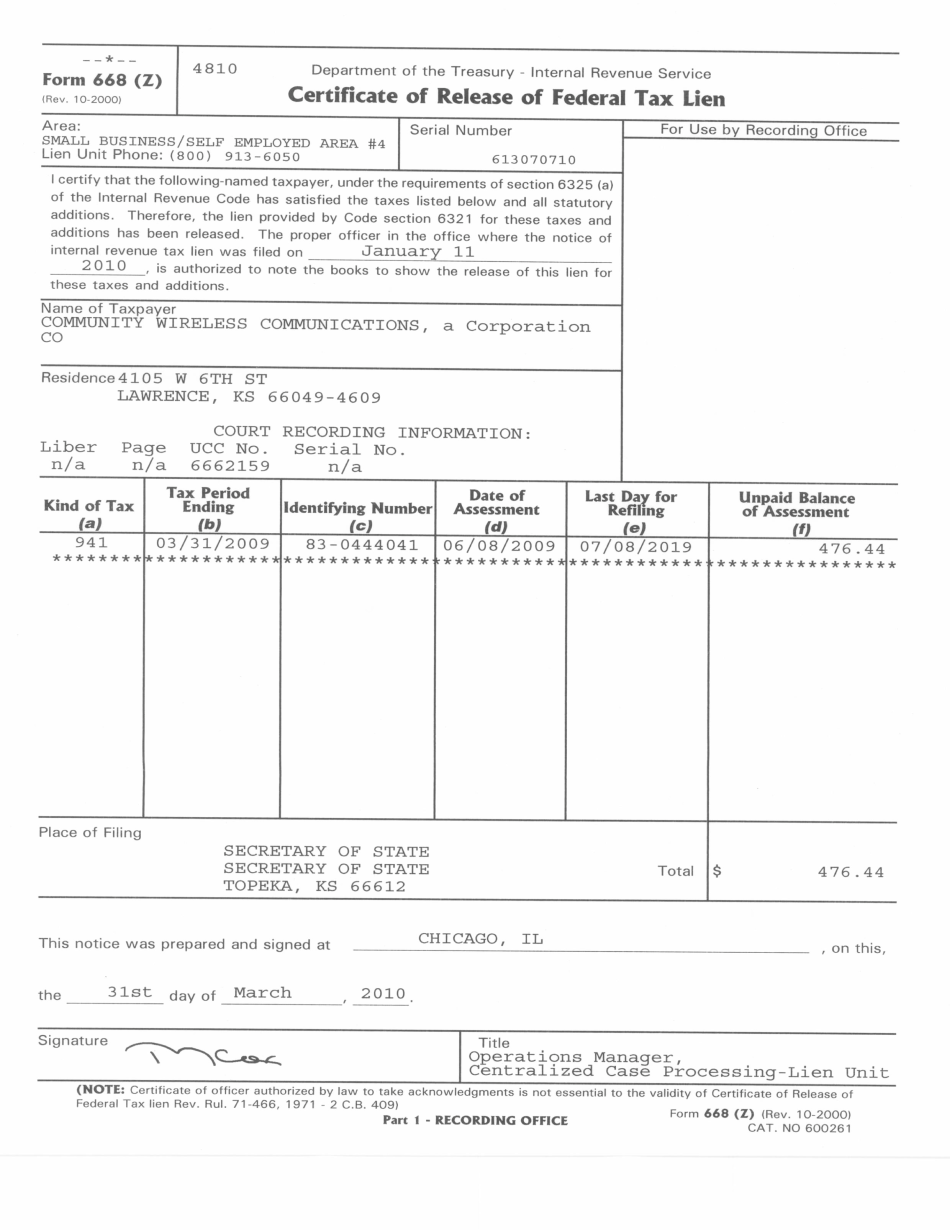

Form 668(Z) Virginia Fairfax: What You Should Know

Unclaimed Treasures — IR-2016-18 Jul 28, 2025 — This tax filing guide explains tax laws and requirements related to tax-exempt organizations, and explains the procedure for contacting, finding. And recovering items that may be claimed as charitable or religious gifts for tax purposes. Treasure: What is it? Treasure is money that is unclaimed or unknown to the IRS. These unclaimed funds are deposited back into the general fund of the Internal Revenue Service. Treasures can be made up of any type of monetary wealth. Treasure can include savings, stocks, bonds, cash or money orders, government check, traveler's checks, money orders, wire transfers, stock certificates, bonds and other debt securities. Treasure funds can be deposited into one of the following accounts: a federal or state income tax withholding account, a federal or state excise tax account, or a federal or state sales tax account. Treasure funds can be deposited with Treasury directly, or into an account controlled by Treasury, such as a Treasury securities account or a Treasury funds account. Treasure funds deposited into one account may be withdrawn at other Treasury accounts held by the same person, to another Treasury accounts in the same name. It is important to know that Treasures must be spent before the funds cannot be withdrawn at another Treasury account. The amount and type of treasure a charitable organization receives depends on the circumstances. Some organizations that receive Treasures are exempt from paying a federal income tax on interest and dividends on treasure funds received and paid. However, Treasures from certain types of income, such as interest from the sale of securities, are taxable. For any other Treasures, you should withhold tax and report as taxable income the amount of the treasure. Treasures obtained from taxable transactions are allowed as a deduction on the organization's federal income tax return. Organizations that obtain Treasures from their investments that are taxed as dividends are subject to a 2.9 percent excise tax on those amounts. Treasure funds deposited into an exempt money market account are tax-deferred, and may be withdrawn as cash without penalty when required by the Secretary. A money market account is an investment that consists of cash plus securities (including treasuries and government notes), money market instruments, commodities, interest and earnings credited to the money market account, and U.S. government certificates of deposit. Treasury money market accounts include: All of Treasury's investment portfolios, including Treasuries, U.S.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 668(Z) Virginia Fairfax, keep away from glitches and furnish it inside a timely method:

How to complete a Form 668(Z) Virginia Fairfax?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 668(Z) Virginia Fairfax aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 668(Z) Virginia Fairfax from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.