Award-winning PDF software

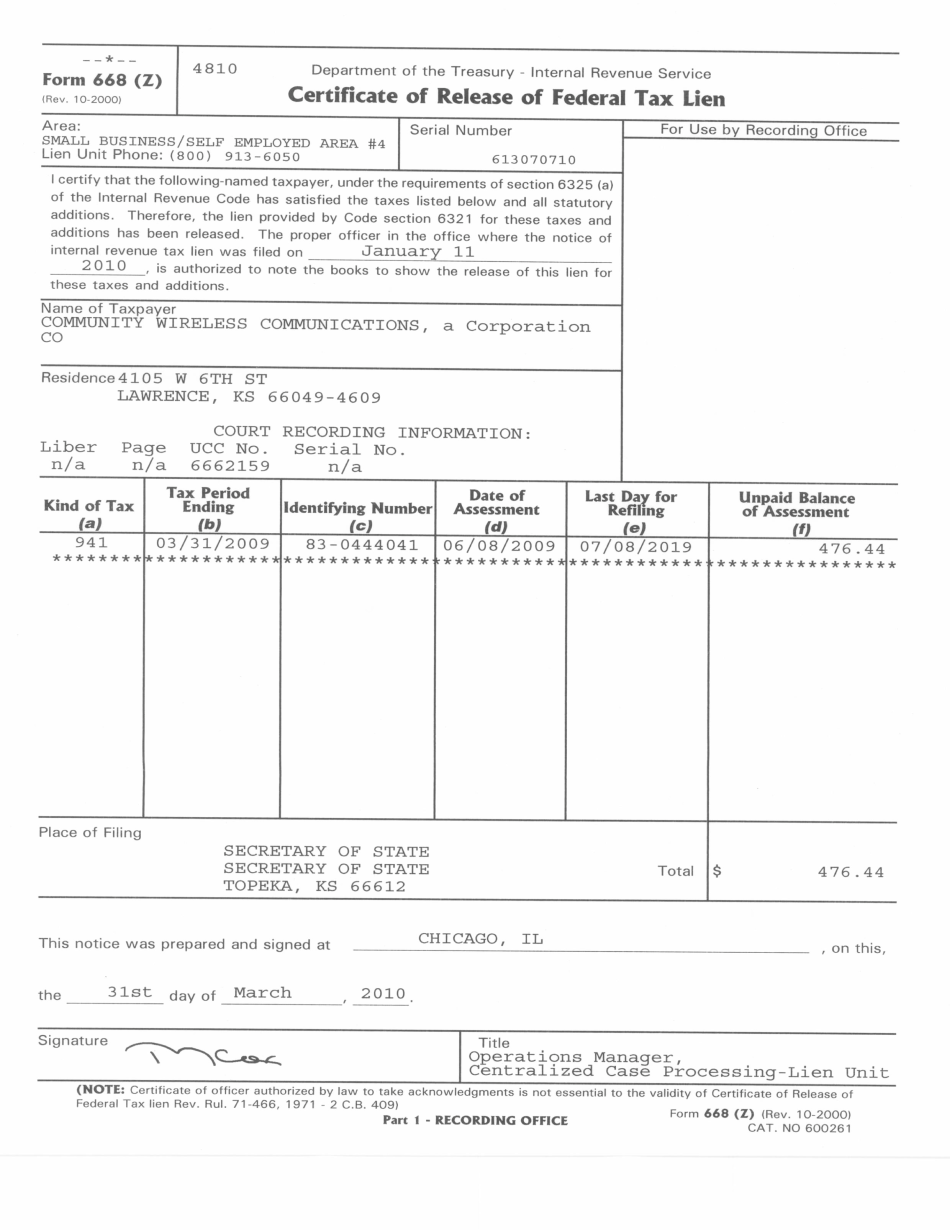

California online Form 668(Z): What You Should Know

For more information or clarification, the IRS can be contacted at (TDD). Learn more about IRS procedures and deadlines for Filing Filing Filing Tax Returns on a Local Government — County Government To obtain an actual copy of the California State and County tax forms, contact the county, For more information or clarification, the County can be contacted at (916) or For additional information to assist you with preparing your return, or in any other matter relating to Your Property: The information provided below are general guidelines. Please do your best to review these Guidelines. You should understand the process at the county and state level prior to making any major decisions regarding your personal property, and all the information contained in this document may not apply to you. Any time you have questions or concerns about your personal property, please provide the county or state that serves you with your information, and we will do our very best to help you address any issues you may have. This information is provided for general information purposes only and is not an offer to buy or sell real property, or the solicitation or acceptance of any property by any person, firm, corporation, or other organization. This information may not be appropriate for all situations, and it should not be relied on as a substitute for advice from your own attorney in all matters involving your personal property. The information in this file can be useful in identifying specific items that may be important and/or helpful in determining a fair market value of your personal property. The information is provided by a local or private company solely for use in connection with the local and/or State real estate process, and is not intended as and does not constitute an offer to sell or the solicitation of an offer from the public. If a property has any outstanding liens, whether due, the county must determine the owner to whom the property is owed. There are many variables that affect the amount of the liens, and it may not be possible to determine this based solely on the information in this information. It is important for you to understand that the owner of any property may decide to pursue or attempt to sell the property, but this action does not mean that any outstanding debt is removed.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete California online Form 668(Z), keep away from glitches and furnish it inside a timely method:

How to complete a California online Form 668(Z)?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your California online Form 668(Z) aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your California online Form 668(Z) from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.