Award-winning PDF software

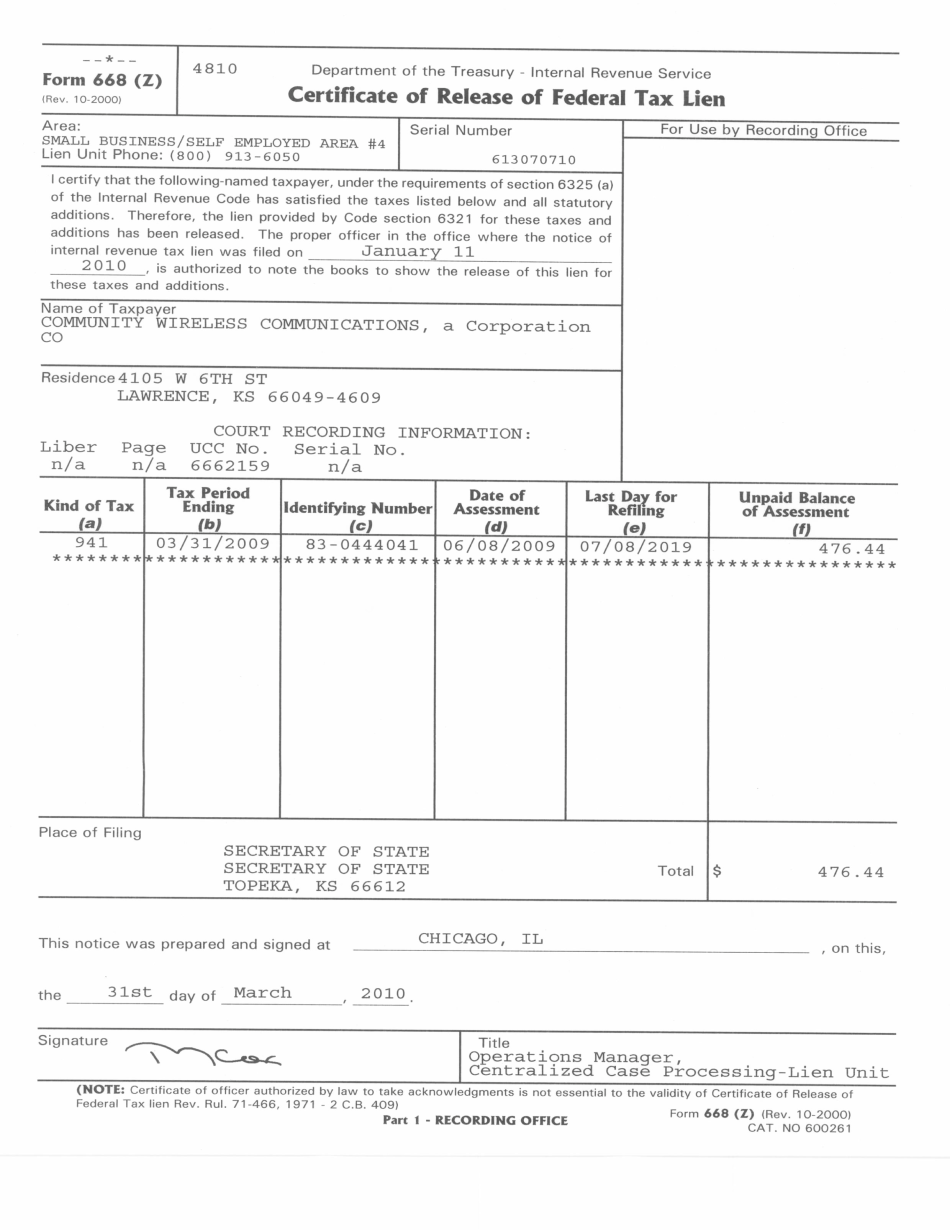

Form 668(Z) online Washington: What You Should Know

Foreign-Born Not Otherwise Qualified Taxpayers — IRS Use Form 8853 (Form 8553) to declare a foreign-born “not otherwise qualified” taxpayers for tax purposes. They are not entitled to the tax benefits available to U.S. citizens and, thus, cannot take advantage of the earned income credit and the child tax credit. Form 8853 Z PDF. Send to IRS. Income from employment and self-employment abroad is not taxable unless an income tax treaty exists. No tax treaty exists with the United Kingdom and Ireland. IRS Form 8853 Z PDF. Use Form 8853 for the Foreign-Born Not Otherwise Qualified Taxpayer and a foreign spouse or domestic partner. Use Form 8853-B, Foreign-Born Domestic Partners, for a foreign non-tax resident spouse or domestic partner living inside the United States. Use Form 8853-C, Foreign-Born Domestic Partner, for a foreign non-tax resident domestic partner living outside the United States. Use Form 8853-Z, Foreign-Born Not Otherwise Qualified Taxpayer for a foreign resident not otherwise qualified. 6.13 Exemptions for Taxpayers With High Education Expenses — IRS Use the Exemptions for Taxpayers With High Education Expenses table to determine if you have to deduct state and local income taxes for your primary residence and your students' high school education expenses. The table determines if you and your family are exempt from the state and local income taxes. If you cannot deduct the taxes you pay, you generally do not have to participate in the education system of your college. However, if you and your family are exempt from paying the taxes, you must claim any tax-exempt benefit you are eligible for under the law. Exemptions for Taxpayers With High Education Expenses Nonresident spouses of United States citizens and those United States citizens residing outside the United States, including Puerto Rico, Guam, American Samoa and the U.S. Virgin Islands. Foreign students attending a qualifying educational institution in the United States, and dependents who live with the taxpayer and who are attending high school in the United States. Students whose state or local income tax is withheld on their federal or state income tax return and who are not required to participate in the education system of their college.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 668(Z) online Washington, keep away from glitches and furnish it inside a timely method:

How to complete a Form 668(Z) online Washington?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 668(Z) online Washington aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 668(Z) online Washington from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.