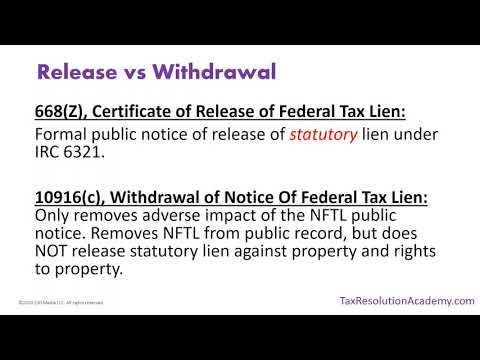

The thing that i colloquially refer to as lien work is technically called lien related certificates so there are multiple different types of lean certificates those are lien releases there is withdrawals subordinations discharges and certificates of non-attachment if you want to delve into the specific sections of the internal revenue code where those are discussed the references are here for you on this particular class for the next four hours what we're going to talk about are withdrawal subordination and discharge we're not going to delve into uh releases or non-attachment those are um covered at the intermediate level class but the one thing that i will say about releases really quick um is to remind you more than anything else because you again advanced class you should know this but remember that a withdrawal and a release are two very different things a release is when the irs is releasing the statutory tax lien the the statutory tax lien that arises the moment the assessment is made per irc 6321 so the 668 z the certificate of release of federal tax lien this is a formal public notice this this gets lodged with a secretary of state's office or county clerk and recorder depending on your state and this is public notice that the the debt has been satisfied okay so it's either expired uh under statutory limitations or it has been paid all right um very different than a withdrawal a withdrawal form 10916c all this does is it removes the form 668y the notice of federal tax lien it removes that notice from public record okay but it is not in any way shape or form an indication that the underlying tax debt is no longer owed okay the tax debts still exists and therefore the...

PDF editing your way

Complete or edit your irs form 668 z anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export form 668z release lien directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your form 668 z pdf as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your 668 z irs form by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare Form 668(Z)

About Form 668(Z)

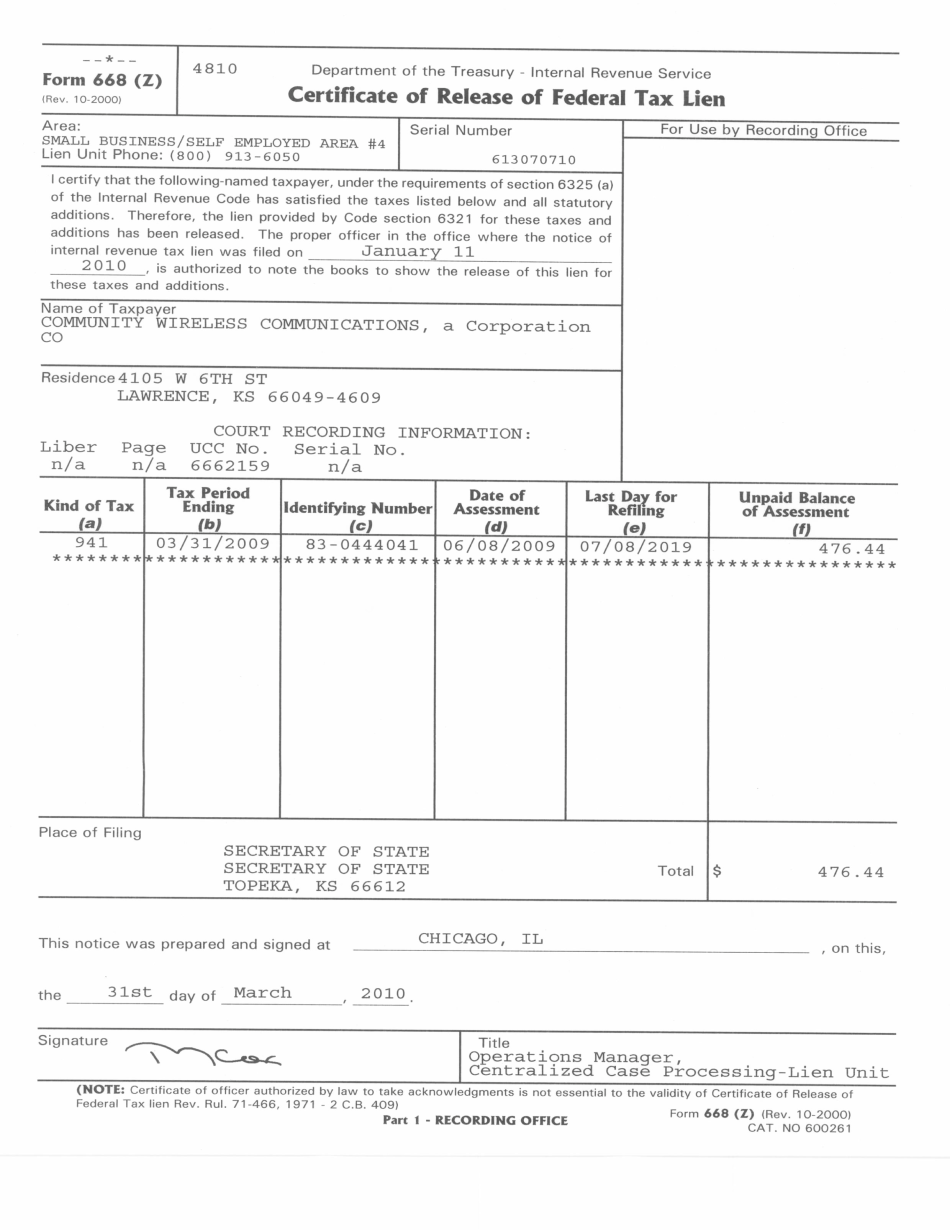

Form 668(Z), also known as a Notice of Federal Tax Lien (NFTL), is a legal document issued by the Internal Revenue Service (IRS) in the United States. It serves as a notification to individuals or businesses with delinquent tax debts that the IRS has placed a lien on their property or assets as a means of securing the outstanding tax liability. The purpose of form 668(Z) is to inform the taxpayer and other interested parties, such as creditors, lenders, or potential buyers, that the IRS has a legal claim to their property. The lien can encompass both real estate and personal property, including but not limited to houses, cars, bank accounts, stocks, or business assets. Typically, the IRS issues form 668(Z) when a taxpayer's unpaid tax liabilities have accumulated to a substantial amount and they have failed to resolve their outstanding debts through other means, such as payment plans or negotiations. It is crucial for taxpayers to address the tax lien promptly, as it can significantly affect their creditworthiness and ability to secure loans or conduct financial transactions. In summary, anyone who owes federal taxes and has failed to pay their outstanding liabilities to the IRS may be subject to the issuance of form 668(Z). This includes both individual taxpayers and businesses, making it essential for them to take immediate action to address the tax lien and resolve their tax debt as soon as possible.

What Is Irs Form 668 Z?

Online solutions allow you to organize your file administration and boost the productivity of your workflow. Observe the short manual to be able to complete Irs Form 668 Z, stay clear of errors and furnish it in a timely way:

How to complete a 668 Z Irs Form?

- On the website hosting the document, choose Start Now and move to the editor.

- Use the clues to fill out the applicable fields.

- Include your personal information and contact data.

- Make sure that you choose to enter appropriate information and numbers in proper fields.

- Carefully verify the data in the document so as grammar and spelling.

- Refer to Help section if you have any issues or address our Support team.

- Put an electronic signature on the Form 668(Z) printable using the assistance of Sign Tool.

- Once the form is done, click Done.

- Distribute the prepared through email or fax, print it out or save on your gadget.

PDF editor enables you to make adjustments to your Form 668(Z) Fill Online from any internet connected gadget, customize it in keeping with your needs, sign it electronically and distribute in several ways.

What people say about us

It's a great idea to submit forms online

Video instructions and help with filling out and completing Form 668(Z)